Retail has changed fast. Stores expect quick responses. Managers want clean visibility. Customers look for steady service. Field teams move across wide territories every day and old methods cannot keep up. A real retail boost happens when people get simple tools that help them work better. Many companies now look for retail technology solutions for field teams because it gives them stability and clear control over daily work.

We work with brands in FMCG, distribution, healthcare, and consumer goods. Many of them struggled before switching to digital tools. Some used spreadsheets. Some relied on phone calls. Many tracked visits by memory. Mistakes were common. Delays were normal. Once they moved to structured tech systems, the improvement was quick. Retail work became smoother and more predictable. Technology is not a fancy idea anymore. It is the base of modern retail operations and a key driver behind a sustained retail boost.

The need for a retail boost through technology

Retail networks are large. Teams face issues like scattered outlets, poor reporting, and slow planning. One company learned a store had not been visited for two months only after a complaint. They had no way to verify field movement in real time. After switching to a location tracking software for retail operations, they got full clarity in a day. This shift matters. It shows how visibility supports better execution and drives a steady retail boost.

Location tracking improves daily retail work

Many businesses now ask for strong location tracking because it gives managers a clear view of team movement. Tracking helps with attendance, route planning, visit accuracy, and territory coverage. Before using proper tracking, one client used WhatsApp photos as evidence. The manager zoomed into each image to check if the store was real. It took hours. With accurate GPS from a location tracking software for retail operations, the process became simple. Trust grows when the system is clear and supports a real retail boost.

Geo tagged check ins prevent errors

Manual check ins create gaps. A visit might be added late or from the wrong place. A geo tagged check in system for sales teams fixes this by recording exact outlet location and time. It links all orders, collections, and tasks to that visit. This removes confusion and manual mistakes. Companies often find many inconsistencies in old reports once they move to automated check ins. Technology removes these issues and strengthens the retail boost they work toward.

Digital ordering speeds up retail cycles

Orders decide retail performance. Field executives using a product catalog on their phone can book orders instantly. A digital order management app for retail outlets keeps prices updated and offers clear. Distributors get orders without delay. This results in quick replenishment. One team earlier used printed lists. When prices changed, they replaced sheets for hundreds of people. After switching to digital catalogs, accuracy improved and retailers trusted them more. Small fixes push steady progress and support a lasting retail boost.

Smarter daily planning for field teams

Many field executives plan by habit. They visit stores in the same order every day even when better routes are available. This leads to long travel and missed calls. Planning tools can arrange visits neatly. A calendar shows upcoming tasks. Reminders keep teams on track. One client saw a large jump in productive visits after using planning tools. Small changes save time and create a daily retail boost.

Offline support protects retail coverage

Many stores operate in weak network zones. Without offline mode, field work stops. An offline retail execution app for remote areas helps people record visits, orders, and payments even with low or no signal. The data syncs when the device reconnects. This matters in rural and semi urban markets. Some teams work in hill regions where signals drop often. Offline mode keeps work visible and maintains a retail boost in hard to reach places.

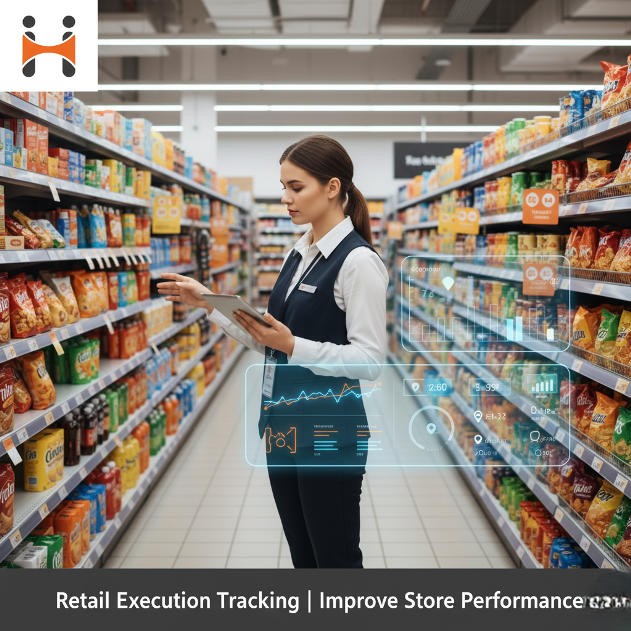

Simple dashboards help managers make good decisions

Managers who wait for end of day reports lose time. A real time retail performance dashboard shows visits, orders, coverage, customer history, and travel patterns instantly. This helps managers act faster. Some clients felt relieved because they no longer had to guess what happened in the market. They could finally see everything live. Better visibility leads to better planning and a clear retail boost.

Recognition increases performance

People perform better when their achievements are visible. Tech tools show targets, progress, pending work, and achievements. Leaderboards highlight top performers. Notifications celebrate milestones. One team earlier used manual incentive lists and many field executives learned about incentives only in the next month. Once incentives were visible in the system, motivation grew quickly. A good system builds confidence and increases the retail boost.

Customer insights build stronger relationships

Retailers expect brands to understand their store patterns. When field executives use a customer history insights tool for field sales, they know past orders, buying behavior, and payment cycles before entering the store. This helps them build trust. A store owner is more willing to increase an order when the salesperson remembers their pattern. Some brands doubled their secondary sales simply by using customer history effectively. Clear information supports human connection and adds a natural retail boost.

Automated reports reduce pressure on managers

Manual reports take time. Managers often work late to prepare summaries. Automated reporting saves hours. The system generates daily and weekly reports without effort. One regional manager gained two hours every evening after switching to automated reports. This reduced stress and improved productivity. Good reporting quietly adds a strong retail boost.

Why companies look for flexible retail systems?

Many businesses want tools that are simple, reliable, and easy for field teams. They want clean tracking, smooth planning, strong offline support, and quick reporting. They prefer retail technology solutions for field teams that match their workflow easily. A good system blends into everyday work and supports the retail boost they expect.

Personal experience from real field stories

One executive walked long distances daily because his territory had narrow roads and hills. After switching to route planning, he saved hours and increased visits. Another manager said he finally understood market activity without waiting for team calls. A distributor reduced stockouts by tracking orders closely. These moments showed how technology supports people and creates a steady retail boost.

The next phase of retail technology

Retail tools will soon offer predictive suggestions, AI visit plans, voice based order booking, and instant market alerts. These upgrades reduce manual work and increase precision. Brands that adopt early stay ahead. The future of retail boost will depend on how smoothly these new tools fit into daily work.

What’s next?

Retail performance depends on accurate tracking, clean visits, smart routes, digital orders, offline support, dashboards, and strong team motivation. Technology connects all these parts. A retail boost starts when systems become simple and teams get the support they need. Retail moves fast. Technology helps people keep pace with it. Book your demo and see how smart retail tech transforms your field operations.